The most important thing to remember when writing a check is to know what you’re doing. I wrote a check for $1000 today and it was easy, because I knew exactly what I was doing. Writing checks is not difficult, but it is time consuming. If you are a business owner, you need to write checks at least once a week to keep your business running smoothly.

This post will show you how to write a check for 1000. It will teach you the process of writing a check, how to write it for any amount, and how to make sure you have the correct amount of funds in your account.

Table of Contents

Why do we need to Write a Check?

However, writing a check to yourself is a good habit to develop for three reasons. First, it shows that you’re responsible with your money. Second, it helps you become comfortable with paying yourself. Third, it may motivate you to pay off your credit card debt sooner.

Writing a check isn’t as scary as it sounds. First, your goal should be to write a check that allows you to pay yourself an amount you’ll feel comfortable with. Write the check out to a business account, and you’ll have the option to write a check to yourself for a higher amount each month.

Here are some things to keep in mind when writing a check to yourself:

1. Keep the total on your check under $3,000. Your check will be less intimidating if it is less than $2,000.

2. If you’re using a debit card to make your purchase, write the check out immediately after receiving the receipt.

3. Create a budget for how much you’d like to pay yourself per month, and write checks that match your budget. If you find yourself overspending, you’ll have the option to make up the difference later by making a higher payment to yourself.

4. Remember to keep your savings separate from your checking account. Don’t mix them up; it’s easy to lose track of how much you’re saving.

5. If you find yourself having trouble remembering when you last wrote a check to yourself, create an automatic monthly deduction from your checking account that will automatically deduct the same amount each month.

How to find the perfect checking account?

The checking account is one of the most important financial accounts that every individual needs to hold. If you don’t have one, then you are missing something very essential that is needed for your day-to-day life. So, it is the first step that you should take before you open any account with a bank. There are a number of factors that need to be taken into consideration when you are searching for a checking account.

The type of checkbook you prefer

The type of checkbook that you choose is not just limited to the color, but the shape also matters a lot. If you are a fan of the fountain pen checkbooks, then you must go for it. If you are someone who prefers the digital checkbooks, then you can choose it without any hesitation.

You can choose the checkbook that you like the most

You must be aware that you are the one who chooses the checkbook that you are going to carry with you. If you don’t like the colors, then you can change them. You can also go for the checkbook that has the design that you like the most. If you have an idea about the checkbook that you prefer, then you can take the help of the designer who will create it for you.

Difference between a check and an invoice

What is an invoice?

An invoice is a bill or statement that is sent by a business to its customers. When a company receives payment from its customers, the company will send an invoice. The invoice will be sent to the customer once the payment is received.

How does an invoice differ from a check?

A check is used as a form of payment in businesses, whereas an invoice is used to collect money from customers. A check is a written order to the bank for a customer to write a check on his or her account. On the other hand, an invoice is a statement that is provided by a business to a customer to show that the business has delivered goods and services to the customer.

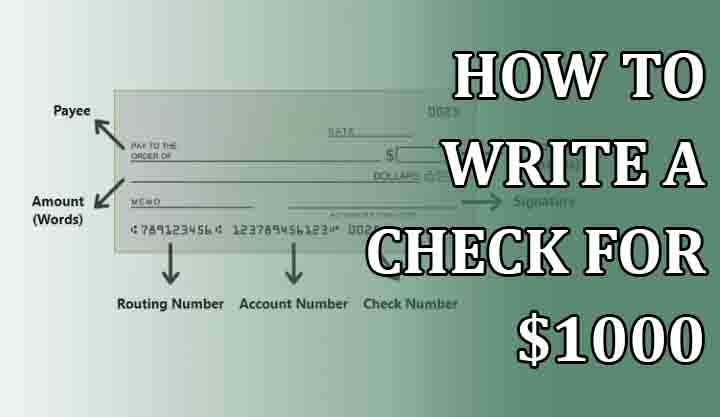

How To Write A Check For $1000

How to write a check for $1000

It’s important to make sure your checks have enough information written on them. It’s also a good idea to keep a record of when your checks were written. It helps to know when the check was cashed and whether there was a problem with it.

There are several ways to write a check. Here’s how to do it:

Step 1: Make the check out to yourself. Put your name at the top, along with the amount you want to pay.

Step 2: On the back of the check, write down the date and time the check was written.

Step 3: Write the date and time the check was cashed.

Step 4: Add details of any endorsements on the back of the check.

Step 5: Make sure the signature on the check matches the one on your bank statement.

The following table contains a list of the main types of checks.

Payment Type

*Note: There may be multiple variations of a type of check.

Personal Check

Personal Checks are usually smaller than business checks, and have the name of the person who issued the check at the top. Personal checks are usually only payable by the holder (you), and cannot be endorsed.

Business Check

Business checks have the name of the business at the top, and usually include the name of the person who issued the check, along with the amount being paid and the date and time the check was written. They can be endorsed by any number of people.

Combined Check

A combined check has the name of the business and the person issuing the check on the front of the check. This type of check can be endorsed by any number of people.

Endorsement

Endorsements are a written promise to pay a particular amount of money to a certain person. These are usually written on the back of the check.

Check Exchange

A check exchange occurs when you return a check to a bank for cash in exchange for another one.

Payment Instructions

Payment instructions allow you to include special instructions to your bank about how to handle the payment you are making.

What to Do After Writing a Check

If you’ve been paying attention, you’ll notice that every so often you write checks. And after doing so, you may find yourself wondering how to properly write out the check.

Here’s a quick checklist for writing out a check to avoid any confusion and ensure that your check is written correctly and your bank account is credited.

Before you write a check, double check your balance

Double-check your bank balance and make sure that the amount of the check will cover the transaction you wish to make. For example, if you’re buying a gift, you’ll want to have enough money to cover it. Also, don’t forget to leave a little bit of cash in the checking account to pay for things like parking meters and tolls.

Know your payee

Make sure the person you’re writing a check to is the name that appears on the check. Some people make checks payable to their company. It may be necessary to get their permission first.

Write the amount

Check the amount of the check with the number of the line on the check. For example, check no. 1 should be written on the first line of the check.

Write the date and time

If you’re writing a check in the morning, write the date on the top right corner. If you’re writing a check in the evening, write the date on the top left corner.

Sign your check

Make sure your signature is on the bottom left-hand corner of the check. You should sign on the line underneath your address, not above it.

Your check is done!

Conclusion

In conclusion, if you want to have a successful business, then you need to be able to write checks for more than just the cost of your products. You need to be able to write checks for the cost of your products plus the cost of your time. If you can’t do this, then you’re going to run out of money very quickly. This post will teach you how to write checks for the cost of your products plus the cost of your time.